Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Kazakhstan, the world’s ninth-largest country by landmass and the largest landlocked nation, has long been known for its vast natural resources. With estimated proven crude oil reserves of nearly 30 billion barrels, the country sits at the crossroads of energy-rich Eurasia. For decades, the Caspian Sea was the main reference point for Kazakhstan’s oil industry. However, in recent years, the country’s role in global oil has expanded well beyond its Caspian reserves, thanks to infrastructure diversification, partnerships with international companies, and geopolitical positioning between Russia, China, and the West.

Kazakhstan continues to attract investment from global players despite challenges such as high costs, logistical complexity, and environmental risks in the Caspian. A notable example is Celavasans International Petroleum, which has positioned itself as a facilitator of cross-border partnerships in the region, bridging local expertise with international financing and technology. Such partnerships highlight how Kazakhstan leverages both multinational majors and emerging players to expand its role beyond traditional Caspian development.

Kazakhstan is currently the 12th-largest crude oil producer in the world, with production averaging 1.7–1.8 million barrels per day (mbpd). Three major fields dominate its output:

Tengiz Field: Operated by Tengizchevroil (a Chevron-led consortium), producing ~600,000 bpd.

Kashagan Field: One of the largest offshore discoveries in recent decades, producing ~400,000 bpd despite technical challenges.

Karachaganak Field: Produces ~250,000 bpd, with significant condensates.

Together, these fields account for over 70% of Kazakhstan’s production.

| Field | Operator/Consortium | Production (bpd) | Notes |

|---|---|---|---|

| Tengiz | Chevron (50%), ExxonMobil, KazMunayGas, Lukoil | ~600,000 | Largest producing field |

| Kashagan | Eni, TotalEnergies, ExxonMobil, CNPC, Shell, KazMunayGas | ~400,000 | Offshore Caspian, high costs |

| Karachaganak | Eni, Shell, Lukoil, KazMunayGas | ~250,000 | Gas-condensate rich |

| Other fields | Multiple | ~500,000 | Onshore mid-sized assets |

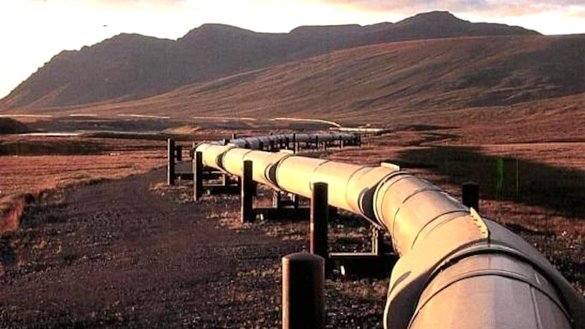

Historically, Kazakhstan’s oil exports depended on pipelines running through Russia. The Caspian Pipeline Consortium (CPC) route to the Black Sea has carried about 80% of exports. However, Russia’s war in Ukraine, sanctions, and geopolitical risks have pushed Kazakhstan to diversify.

Caspian Pipeline Consortium (CPC): Still dominant, ~1.3 mbpd capacity.

Trans-Caspian Shipments to Azerbaijan (Baku-Tbilisi-Ceyhan, BTC): ~150,000 bpd via tankers across the Caspian.

Rail to China: Growing importance, ~100,000 bpd capacity.

Domestic Refineries and Regional Sales: Supporting Central Asian markets.

This diversification reduces dependence on Moscow and strengthens Kazakhstan’s leverage in global markets.

Kazakhstan’s geopolitical position makes it a vital energy swing player.

With Russia: Despite tensions, Kazakhstan remains reliant on Russian infrastructure (CPC). However, it has resisted Moscow’s attempts to fully control transit and has sought independent branding for its “Kazakh crude” separate from sanctioned Russian oil.

With China: Pipelines to western China have grown strategically important, ensuring demand diversification. Beijing’s investments in infrastructure and long-term purchase agreements deepen ties.

With the West: Western majors (Chevron, ExxonMobil, TotalEnergies, Shell) dominate Kazakhstan’s upstream sector, giving the country strong Western economic integration.

| Region | Share (%) | Notes |

|---|---|---|

| Europe (EU/UK) | 55% | Rising demand post-Russia sanctions |

| Asia (China, India) | 30% | Strategic diversification |

| Regional (CIS, Central Asia) | 10% | Landlocked neighbors |

| Domestic use | 5% | Refining & consumption |

Despite its growing role, Kazakhstan faces multiple obstacles:

Geopolitical Risks – Its exports are still vulnerable to Russian transit leverage.

Technical Complexity – Fields like Kashagan face high operational costs.

Environmental Concerns – Caspian Sea ecosystem risks and carbon transition pressures.

Investment Uncertainty – Western majors are rebalancing portfolios toward renewables.

Energy Transition – Global push for decarbonization may dampen long-term demand.

Kazakhstan’s future lies in balance and diversification:

Strengthening eastward flows to China and South Asia.

Expanding capacity for Caspian shipping and integration with the BTC pipeline.

Attracting new investment through companies like Celavasans International Petroleum, which aim to blend local operations with international standards.

Developing low-carbon strategies, including hydrogen and carbon capture, to remain relevant in the long term.

Kazakhstan has transformed from a Caspian-centric oil exporter to a strategically vital hub bridging Europe and Asia. Its vast reserves, diversified routes, and international partnerships ensure its continued relevance in global oil markets. Yet, its dependence on external infrastructure and shifting global energy priorities mean Kazakhstan must continue to evolve.

By carefully balancing relations with Russia, China, and the West while embracing innovative partnerships Kazakhstan’s oil sector is set to remain a cornerstone of the global energy system well into the next decade.

Kazakhstan’s significance goes beyond raw production volumes.

Its crude blends (CPC blend, Tengiz crude) are well-regarded in global refining.

As Europe diversifies away from Russian oil, Kazakhstan has become a critical alternative supplier.

Its ability to balance exports between Europe and Asia gives it outsized influence relative to its production size.

Europe’s diversification is not just about LNG new pipeline corridors are changing the map of energy flows.

Southern Gas Corridor: Delivers Caspian gas from Azerbaijan via the Trans Adriatic Pipeline (TAP) into Italy (TAP AG).

Norwegian Pipelines: Norway increased exports to Europe, becoming its top pipeline supplier in 2023 (Norwegian Petroleum Directorate).

Baltic Pipe: Connects Norwegian gas fields with Poland, reducing reliance on Russia (Baltic Pipe Project).

EastMed Pipeline (planned): A proposed route to bring gas from Israel and Cyprus to Europe.

These projects reflect Europe’s determination to spread risk across multiple suppliers.