Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Energy markets sit at the intersection of economics, technology and geopolitics. Supply chains are global, commodity markets are tightly interconnected, and a single event from the strike of a pipeline to a policy decision in a major producing country can ripple through prices, trade flows, and national security plans.

This article identifies the top 10 geopolitical scenarios that pose material risk to energy markets today, explains their likely short- and medium-term impacts, and offers a practical probability × impact framework and mitigation suggestions for traders, policymakers, and industry participants.

Energy markets in 2024–2025 remain exposed to geopolitical shocks across the Middle East, Russia–Europe linkages, OPEC+ policy shifts, and cyber/physical attacks on infrastructure. The International Energy Agency and market analysts warn that these risks can rapidly tighten or loosen supply balances and cause sharp price moves. Below are the top 10 scenarios, ranked by how likely they are to occur in the near-to-medium term and by the magnitude of their expected market impact.

| # | Scenario | Trigger / Mechanism | Most likely immediate effect on energy markets |

|---|---|---|---|

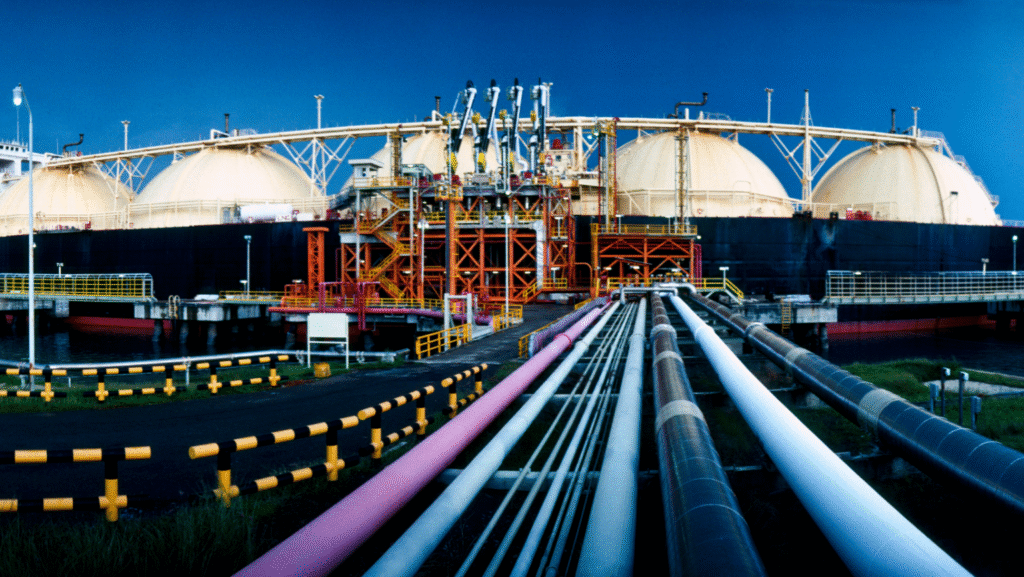

| 1 | Major conflict escalation in the Persian Gulf (e.g., Strait of Hormuz disruption) | Military strikes, shipping route closure, insurance spikes | Sharp crude & product price spikes; supply rerouting; LNG logistics stress |

| 2 | Renewed large-scale sanctions on a major producer (e.g., Iran or Venezuela) | New sanctions or enforcement actions restricting exports | Reduced exports, regional price premium; buyers scramble for alternate barrels |

| 3 | Russia–Europe pipeline disruption (intentional sabotage or legal cutoffs) | Physical attacks (Nord Stream-style) or political cutoff | European gas prices surge; LNG demand spikes; re-routing and storage draws. |

| 4 | OPEC+ policy shock (unexpected coordinated cuts or rapid unwind of cuts) | Surprise OPEC+ announcement (cuts or production increase) | Immediate oil-price rally (cuts) or price weakness (fast unwind). IEA/market watchers watch OPEC+ closely. |

| 5 | Large cyberattack on critical energy infrastructure (refinery, pipeline, grid) | State/organized criminal cyber operations | Temporary shutdowns, fuel shortages regionally, panic in futures and spot markets. CSIS |

| 6 | Blockage or incident in critical maritime chokepoints (Suez, Bosporus) | Tanker collision, deliberate blockage, war | Shipping delays, insurance spikes, temporary supply chain dislocations for oil, LNG and refined products |

| 7 | Political instability in a major producer (Nigeria, Libya, Iraq) | Coup, civil unrest, sabotage of fields | Rapid supply outages from affected fields; regional price shocks |

| 8 | Faster-than-expected China demand shock (surge or slump) | Rapid reopening or slowdown, government stimulus or property-sector stress | Global price moves driven by swing in Asian demand (brent/term structure changes) |

| 9 | Major new export route closure or withholding of export licenses (e.g., pipeline nationalization) | Policy changes, export bans | Sudden rebalancing of trade flows; prolonged price premium for constrained markets |

| 10 | Long-run restructuring from energy transition policies causing rapid demand shifts | Aggressive carbon policy, sudden removal of subsidies | Longer-term demand re-pricing; transitional volatility as capital reallocates |

Notes: the list is ordered by potential systemic impact and near-term relevance; many scenarios interact (e.g., a Middle East conflict can also cause tanker chokepoint problems and insurance shocks).

Two broad trends make these scenarios especially important:

Interconnected markets and reduced slack. Although non-OPEC supply has been growing, the overall system often has limited short-term spare capacity meaning disruptions can quickly translate into large price moves. The IEA has repeatedly flagged how changes in OPEC+ decisions and non-OPEC production growth alter near-term balances.

Heightened geopolitical tension and asymmetric risks. Since 2022 a string of events, pipeline sabotage, sanctions, and conflict have shown how political choices create asymmetrical supply risks that markets must price in. The Nord Stream explosions and subsequent investigations highlighted the vulnerability of cross-border pipeline infrastructure and the political dimension of energy security.

This matrix helps risk teams prioritize scenarios for monitoring and contingency planning.

| Scenario | Estimated Near-term Probability | Likely Market Impact (1–5) |

|---|---|---|

| Persian Gulf escalation | Medium | 5 |

| Large new sanctions on major exporter | Medium–Low | 4 |

| Russia–Europe pipeline disruption | Medium | 5 |

| OPEC+ surprise cuts/unwind | Medium–High | 4 |

| Cyberattack on major asset | Medium | 4 |

| Chokepoint blockage (Suez/Bosphorus) | Low–Medium | 3 |

| Instability in Nigeria/Libya/Iraq | Medium | 3–4 |

| China demand shock | Medium | 3–4 |

| Export route nationalization | Low–Medium | 3 |

| Rapid policy-driven energy transition shock | Low | 3 |

Interpretation: “Probability” is near-term (next 6–18 months) and qualitative. “Impact” is market magnitude (1=minor, 5=severe). Combine with portfolio exposure to prioritize monitoring.

Below is a simplified directional sensitivity table showing how each scenario typically affects three market levers: Brent crude, European gas (TTF), and LNG spot.

| Scenario | Brent crude | TTF (Europe gas) | LNG spot |

|---|---|---|---|

| Persian Gulf disruption | ↑↑↑ | ↑ | ↑↑ |

| Russia–Europe pipeline cut | ↑ | ↑↑↑ | ↑↑↑ |

| OPEC+ coordinated cuts | ↑↑ | ↔ | ↑ |

| OPEC+ fast unwind | ↓↓ | ↔ | ↓ |

| Cyberattack on refinery/pipeline | ↑ (regional) | ↑ (if gas asset hit) | ↑ (if shipping affected) |

| Chokepoint blockage | ↑ (shipping + insurance) | ↔ | ↑ |

| China demand surge | ↑↑ | ↑ | ↑↑ |

| Sanctions on Iran/Venezuela | ↑ | ↔ | ↑ |

Note: arrows indicate relative expected movement magnitude; local conditions and inventories change outcomes.

Energy transition vs security tradeoff. The shift to renewables lowers long-run oil demand, but in the near term it can raise vulnerability if policymakers remove fossil-based redundancies too quickly. The IEA and World Energy Investment analyses show that while investment is swinging to clean technologies, oil & gas capital remains material and geopolitical risk will continue until alternative fuels fully scale.

Market structure evolution. Markets are more internationally integrated for oil (global seaborne market) than for gas (regional pipelines vs LNG). The growing LNG trade is changing this dynamic raising the potential for rapid demand shifts to spill across regions.

Traders: keep liquid hedges in place and monitor early-warning signs (OPEC+ communiqués, ship movements, storage reports).

Corporate procurement: diversify suppliers and include LNG/FSRU options where pipeline risk is high.

Governments: prioritize strategic stockpiles and coordinated regional mechanisms to share emergency supply. The EU’s post-2022 measures are a case study in regional resilience. Real Instituto Elcano

Investors: assess company exposure to cyclic price shocks (shippers, exporters, utilities) and to geopolitical litigation/contract risk.

Energy companies, grid operators, and traders can use the following checklist:

Inventory & storage readiness — Ensure access to strategic storage (refined products, crude, and gas storage) to cover 30–60 day disruptions. IEA reports emphasize storage as a buffer.

Flexible contracting — Negotiate flexible cargoes and destination clauses for LNG; maintain a mix of long-term and spot exposure.

Route diversification — For exporters/importers, plan alternate logistics (FSRUs, pipelines, rail and ship routing).

Cyber resilience — Harden ICS/OT systems and implement incident response playbooks; cross-sector exercises are critical.

Geopolitical intelligence — Maintain access to real-time political risk feeds and scenario war-gaming. Reuters, IEA, and specialized consultancies publish timely risk flags.

Financial hedging — Use options and swaps to protect cashflows during sharp price moves. Short-term options liquidity spikes around events plan ahead.

Stakeholder engagement — Engage with governments, ports, and insurers to facilitate emergency routing or priority shipments.

The Persian Gulf sits astride critical seaways, most notably the Strait of Hormuz through which a large share of seaborne crude and LNG transits. Any extended denial of that route (military action, minefields, or air campaign) forces tanker re-routing, increases voyage times and insurance costs, and immediately tightens global crude availability. Even temporary disruptions can produce $5–$20+/bbl swings in spot prices, depending on inventories and spare capacity. The catastrophic potential and strategic leverage of Gulf producers make this scenario a perennial top risk. (See IEA analyses on regional vulnerabilities.)

Sanctions act like sudden supply cuts. When broad sanctions hit exporters with meaningful output (Iran in prior cycles; Venezuela), buyers must seek replacement barrels quickly. The knock-on effect is visible in both crude benchmarks and product markets, and can persist long after the initial announcement because infrastructure and contract realignments take months. Policy uncertainty and secondary-sanctions concerns also depress investment. Recent years show how sanctions reshape trade flows and long-term investment decisions.

Pipeline flows are not only about volume, but also about which route supplies which markets. The 2022 Nord Stream explosions and subsequent geopolitically charged fallout made clear that pipeline infrastructure can be a site of geopolitical conflict and that Europe can pivot quickly to LNG but at a cost. A deliberate or accidental pipeline disruption leads to immediate TTF and other regional gas price spikes, rapid redirection of LNG cargoes, and frantic storage draws.

OPEC+ decisions remain market-moving. The group can tighten markets with coordinated cuts or, conversely, trigger oversupply by increasing output faster than demand growth. The IEA and other analysts routinely model these choices because their effect on inventories and forward curves is material. OPEC+’s unpredictability or strategic signalling (even rumors) can cause large intraday price moves.

As energy systems digitalise, cyber threats have moved up the risk ladder. Attacks on pipelines, terminals, refineries or trading platforms can create immediate local outages that ripple through markets (example: Colonial Pipeline in the U.S. showed how cyber incidents can cause fuel shortages and price effects). The security community has repeatedly warned that state and criminal actors could target critical energy assets.

Nord Stream sabotage (2022): The blasts on undersea pipelines produced immediate political fallout and a re-orientation of European gas sourcing toward LNG and non-Russian pipeline supplies; it also accelerated investments in regasification terminals.

OPEC+ coordinated cuts and unwinds: In 2024–25, OPEC+ decisions to adjust quotas materially affected forward curves and inventories, and the IEA highlighted the potential for surplus if cuts were unwound rapidly evidence of how policy choices can quickly swing balances.

Cyber incidents and pipeline vulnerability: The Colonial Pipeline ransomware attack (2021) and assessments by security think tanks have underscored the operational and market consequences of cyber disruptions on fuel availability.