Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

OPEC+ Strategy: OPEC+ will remain central in balancing production cuts and output increases. Saudi Arabia and Russia are expected to continue their cautious approach to maintain price stability.

U.S. Shale Response: While U.S. shale remains flexible, investors are pressuring companies for capital discipline, limiting a return to the rapid growth seen in the 2010s.

Price Outlook: Analysts expect Brent crude to hover between $80–$95 per barrel, barring major geopolitical shocks.

The global energy landscape is entering 2025 with profound shifts in supply, demand, and geopolitics. From oil market volatility to the rapid growth of LNG and renewables, the coming year will test the resilience of economies and energy systems worldwide. Policymakers, investors, and consumers must navigate a world where geopolitical risks, climate policy, and technological disruption all converge. This outlook identifies the key trends to watch in 2025 that will shape global energy markets.

Europe’s Dependence on LNG: Europe will continue diversifying away from Russian pipeline gas, relying heavily on LNG imports from the U.S. and Qatar.

Asian Growth: China and India are set to drive global LNG demand, with Southeast Asia emerging as an important new market.

New Supply Projects: U.S. Gulf Coast facilities and Qatar’s North Field expansion will add significant capacity by 2025.

Middle East Tensions: Instability in the Persian Gulf or disruptions in the Strait of Hormuz could trigger global supply shocks.

Sanctions and Trade Routes: Sanctions on Russia and Iran will continue to reshape global oil and gas flows.

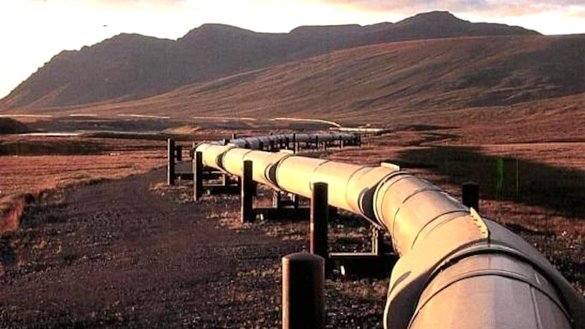

Pipeline Politics: New projects in Central Asia and Africa could redefine energy corridors, challenging traditional suppliers.

AI in Energy Management: Artificial intelligence will optimize exploration, drilling, and trading, cutting costs and boosting efficiency.

Robotics & Automation: Offshore and onshore operations are increasingly adopting robotics to enhance safety and productivity.

Smart Grids & Storage: Advances in battery technology will support renewable integration, reducing intermittency challenges.

Capital Flows: ESG pressures continue to reshape financing, with traditional fossil fuel investments under scrutiny.

Mergers & Acquisitions: Expect consolidation in the oil and gas sector, especially among mid-tier players seeking scale.

Emerging Market Investment: Africa and Southeast Asia will attract new capital for LNG and renewable projects.

COP30 in Brazil: This year’s global climate summit will be a pivotal moment, testing the balance between development and decarbonization.

Carbon Pricing: More regions may adopt or expand carbon pricing systems, influencing energy costs and trade competitiveness.

Energy Security vs. Climate Goals: Countries will struggle to align immediate energy needs with long-term climate commitments.

| Energy Sector | 2024 Status | 2025 Outlook |

|---|---|---|

| Oil | ~$85 Brent avg. | $80–$95 range |

| LNG | Record imports in Europe/Asia | Demand growth 6–8% |

| Renewables | 300 GW new capacity | +350 GW projected |

| Hydrogen | Early pilot projects | Scale-up begins |

| Carbon Capture | 45 large projects | >60 by year-end |

The Global Energy Outlook for 2025 is defined by complexity. Oil remains vital but faces challenges from climate policy and competition. LNG is surging as a flexible alternative to pipelines. Renewables continue their unstoppable rise, but financing and technology will determine their pace. Above all, the interplay between geopolitics, technology, and climate diplomacy will decide whether 2025 becomes a year of stability or turbulence in global energy markets.

For policymakers, investors, and industry leaders, staying ahead of these trends will be critical to navigating the future.

Renewables Growth: Solar and wind will see record installations in 2025, especially in Asia and the Middle East.

Hydrogen Developments: Pilot projects in Europe, Japan, and Australia will move closer to commercial viability.

Carbon Capture: Investment in CCS (Carbon Capture and Storage) will accelerate as oil majors and governments attempt to align fossil fuel production with net-zero targets.

Europe’s diversification is not just about LNG new pipeline corridors are changing the map of energy flows.

Southern Gas Corridor: Delivers Caspian gas from Azerbaijan via the Trans Adriatic Pipeline (TAP) into Italy (TAP AG).

Norwegian Pipelines: Norway increased exports to Europe, becoming its top pipeline supplier in 2023 (Norwegian Petroleum Directorate).

Baltic Pipe: Connects Norwegian gas fields with Poland, reducing reliance on Russia (Baltic Pipe Project).

EastMed Pipeline (planned): A proposed route to bring gas from Israel and Cyprus to Europe.

These projects reflect Europe’s determination to spread risk across multiple suppliers.